Celebrate World Telecommunications Day - sharpen your digital literacy

Celebrate World Telecommunications Day by enhancing your tech skills and helping others do the same.

.jpg)

Celebrate World Telecommunications Day by enhancing your tech skills and helping others do the same.

Get ready for big savings without compromising your mobile and internet service when you sign up for the Ting mobile bundle.

Is Ting a better internet provider than AT&T? Dive into our in-depth evaluation encompassing speed, reliability, value, and customer satisfaction...

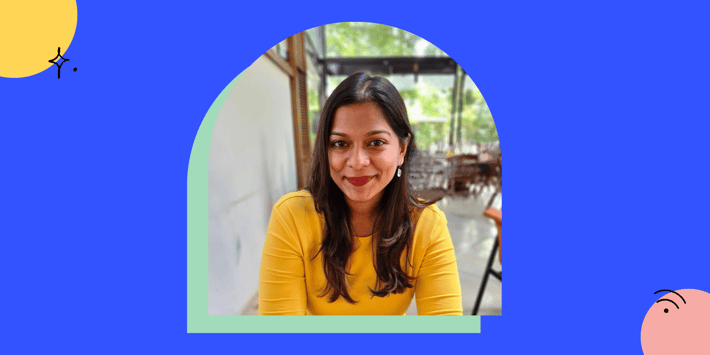

This month's Ting Internet Employee Spotlight shines on Shilpa Dsouza, an analytics manager who took an unconventional path to this career.

Discover if Ting Internet is a better choice than Spectrum. Explore our detailed comparison highlighting speed, reliability, value, and customer...

Discover the Girls Who Code chapters in Ting towns.

Is Ting Internet a better choice than Cox? Dive into our comprehensive analysis covering speed, reliability, value, and customer support, and make...

It’s all about surfing, music and supporting the community with Ting Internet at the Switchfoot Bro-Am Beach Fest on June 15, 2024.

Unlock the power of gigabit internet infrastructure. Discover how it fuels innovation, enhances everyday activities, and promotes digital inclusion.

What is fast internet and why does it matter? Not all high-speed connections are created equal—let's find out why.

Did you know fast upload speeds are crucial for activities like video calling, cloud storage, and gaming? Find out why upload speeds matter a lot...

This month's Ting Internet Employee Spotlight shines on Heather Smith, a product manager who has been with the company for two years.